Guide 2024:

AI automation for insurance companies

- Use Case

- Laura Saße-Middelhoff

Automation potential in the insurance industry

The insurance industry is facing a profound transformation, driven by advancing digitalization and innovative technologies. One of the key components of this transformation is the automation of processes, which not only increases efficiency but also improves the customer experience. Allianz reports in its Global Risk Dialogue Reportthat the insurance industry is one of the industries with the highest value potential of AI technologies, which could generate an annual potential of 1.1 trillion dollars.

But which specific areas can be automated in the insurance industry?

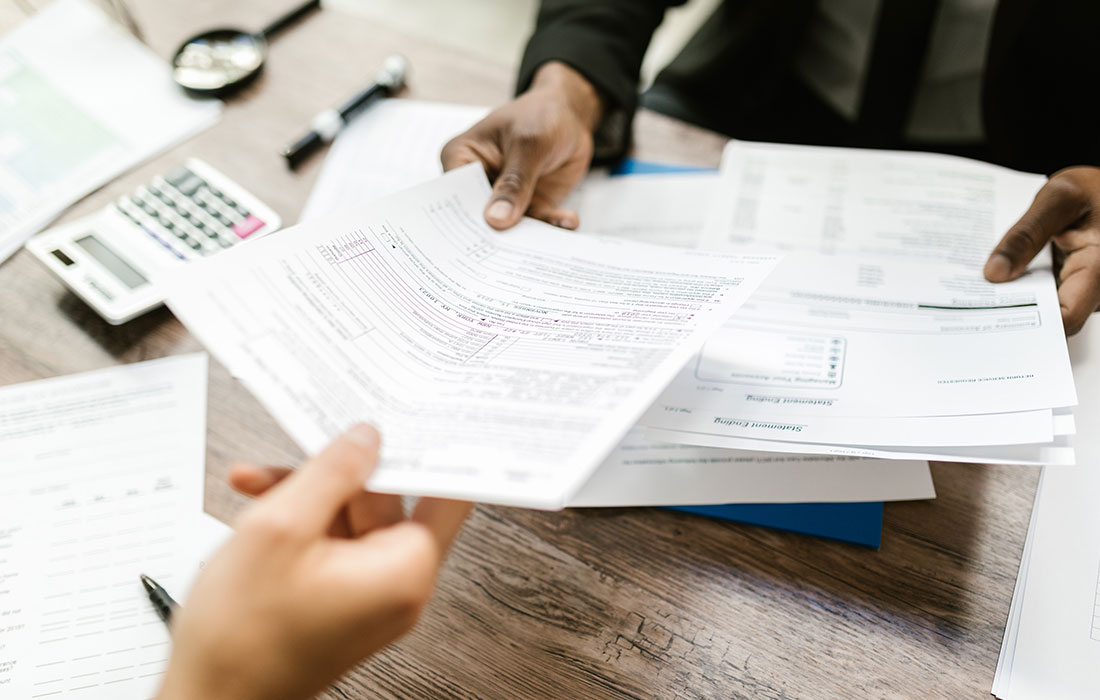

Application and policy management: Manual processing of insurance applications and policies can be time-consuming and error-prone. The use of automated systems can speed up these processes and minimize errors. Artificial intelligence (AI) and machine learning enable faster and more accurate identification of relevant information, resulting in faster processing of applications and efficient policy management.

Customer communication: Chatbots and virtual assistants can play an important role in customer communication. They can answer frequently asked questions, provide information on policies and even receive simple claims notifications. By automating communication processes, customer service becomes available around the clock and enables insurance companies to respond quickly to inquiries.

Risk assessment and underwriting: Traditional underwriting processes can be optimized through the use of data analysis and AI models. Automated systems can analyze large amounts of data in real time, enabling more accurate risk assessments. This not only helps to improve underwriting efficiency, but also supports the development of customized insurance products.

The advantages of AI automation

The introduction of automation technologies in the insurance industry brings with it numerous benefits that not only increase operational efficiency, but also improve the overall experience for insurance companies and customers. Some examples include:

Increased efficiency: One of the most obvious benefits of automation is the significant increase in efficiency. By using automation in various processes, from application processing to policy management and claims settlement, insurance companies can save time and resources. This makes it possible to speed up processes, minimize errors and focus employees on value-adding activities.

AI automation through intelligent document processing

Intelligent Document Processing (IDP) is becoming an indispensable cornerstone in the evolution of the insurance industry by fundamentally transforming traditional document processing. This groundbreaking technology enables extensive automation of repetitive and labor-intensive tasks associated with processing insurance documents. IDP uses advanced technologies such as machine learning and optical character recognition (OCR) to ensure accurate data capture. This leads to a significant reduction in processing times and allows employees to focus on more demanding, value-adding activities.

One area in which IDP particularly stands out is accelerated claims processing. By automatically extracting relevant information from claims reports, the processing speed can be significantly increased. This not only contributes to more efficient claims settlement, but also results in improved customer satisfaction thanks to fast response times on the part of the insurance companies.

The positive impact of IDP also extends to customer service as a whole. The automated processing of inquiries, policies and other documents enables insurance companies to deal with customer concerns accurately and promptly, which in turn leads to an optimized customer experience.

In addition, IDP supports compliance initiatives in the insurance industry by ensuring that all documents are processed and archived in accordance with applicable regulations. This helps to minimize risks and prevent potential legal consequences.

Overall, Intelligent Document Processing manifests itself as a transformative force that not only leads to a significant increase in efficiency in the processing of insurance documents, but also positions insurance companies for future-oriented development. The use of IDP thus becomes a strategic competitive advantage that leads the industry towards a more effective, customer-oriented and technologically advanced future.

Buildsimple: "All-in-one" software for intelligent document processing

Buildsimple offers you the full range of intelligent document processing - bundled in various AI solutions: from automatic separation, classification and reading of your documents to content analysis. Buildsimple can be used as a cloud platform - without any knowledge of AI. Convince yourself of our quality and ease of use:

- Artificial intelligence and cloud

- Can be used in BaFin-regulated companies

- Ø 90% time saving per document

- Up to 98% accuracy in data extraction

- Ø 70% cost savings after 6 months

Latest posts

Don't miss any news

Subscribe to our newsletter for the latest news, developments and functions relating to Buildsimple.

Further contributions